Since returning from a vacation partly spent isolated from the internet, I’ve been catching up and noticed that some of the most prominent sources of funding for math and physics research have been making the news:

- The New York Times and other sources have extensive reports based on leaked records from an offshore law firm that specializes in helping you avoid inconvenient US tax and reporting requirements. The story starts out with the example of Jim Simons, who has become the largest non-governmental funder of math and physics research. His Simons Foundation has been doing an excellent job of providing such funding. They have about \$3 billion in assets, annual income of around \$500 million. The Times reports that Simons (with a net worth of about \$18.5 billion) has an offshore version of the Foundation, the Simons Foundation International, with assets of \$8 billion, dwarfing the onshore version.

- The assets of these Foundations are presumably largely invested in the secretive and extremely successful Renaissance Technologies hedge fund, which also is the employer of quite a few physicists and mathematicians. I’ve asked many people over the years, but have never found anyone who knows (or will admit to knowing) what it is that RenTech does that is so successful. A peculiar aspect of the coming age of private math/physics research funding is that no one getting this funding really knows where the money comes from.

In other news while I was away the CEO of RenTech, Robert Mercer, was finally induced to leave. Mercer had drawn a lot of attention recently since he in recent years has been taking the opposite tack to Simons, funding institutions devoted to promoting untruth over truth (e.g. Breitbart News), achieving fantastic success last year. He also has branched out from doing whatever secretive things RenTech does to make mountains of money using computers and data, starting up a firm called Cambridge Analytica, a firm involved in secretively using computers and data to undermine democracy in the US and elsewhere. I had been wondering for quite a while what Simons thought of Mercer’s activities. My understanding of highly-paid finance jobs was that your employer pays you a lot of money in return for having your full attention and devotion to not having negative stories about them come to public attention, so Mercer’s continued employment was surprising. It seems that Simons finally had enough, after realizing how much damage Mercer was doing to his firm, in particular by creating a situation that would discourage many people from wanting to work there (there also was a campaign underway to get institutions to divest from investments with RenTech).

- Another high profile source of funding for math and physics, in this case for cash prizes to mathematicians and physicists, has been venture capitalist Yuri Milner, with his Breakthrough Prize organization. New prizes will be announced in three weeks at a December 3 prize ceremony (I also believe there will be an associated Breakthrough Prize symposium held at Stanford shortly thereafter). It has always been well-known that much of Milner’s wealth derived from investments in Facebook and Twitter. Less well-known and recently revealed was that a major source of the funds for these investments was Russian state organizations closely tied to Vladimir Putin.

- Turning to sources of public funding, there’s not very positive news about a possible ILC collider in Japan, with reports of a cutback of the proposal from a 500 GeV to a 250 GeV machine (which would still cost about $7 billion).

- Foreign policy magazine has an article discussing the proposal for a huge new collider in China (discussed here). The point of view of the article is quite critical of the idea of locating a huge new project in a country with an increasingly authoritarian regime:

China’s next-generation supercollider will unlock secrets of the universe — and destroy the ideals of the scientists running it.

Luckily, for another more local prominent large country with an increasingly authoritarian and xenophobic regime, the issue of a possible problem with locating an international collider project there isn’t likely to come up since its leaders have no interest in funding such projects.

Evidently, Mercer is going to be replaced by someone else in the inner circle. I wonder what the consequences will be…

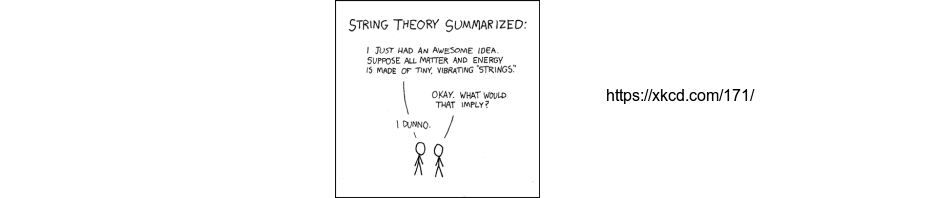

Hmmm? Maybe Milner’s vast investment in string theory is part of Putin’s plot to divide the West;-)

To the extent that there are Finance Koans, my favorite is “One trader goes long, the other goes short. They both make money.” The point, of course, is that any trade has an entry and an exit. People always forget about the exit. The hardest part of trading is knowing when to get out of a trade, and having the discipline to get out when your knowledge or algorithm tells you to.

I have no special insight into Renaissance, having answered “No” to the first interview question: “Would you move to Stony Brook?”, but I think discipline has as much to do with their success as superior analytics.

Behind every great fortune there is a crime.

—Balzac

Peter, sorry for the OT notice. But are you planning to attend this discussion on string theory

https://pioneerworks.org/programs/scientific-controversies-no-13/

2 from Twain:

(1) Honesty is the best policy — when there is money in it.

(2) Virtue never has been as respectable as money.

Shantanu,

Thanks for pointing that out, I hadn’t heard about it. Quite possibly I will go out there for that. Interesting that an event covering a “scientific controversy” is being planned, with only one side of the controversy represented…

I think Mercer is leaving his management role at Renaissance, but continuing work in their models/algo division

Talking about funding, the Republican tax bill will make graduate tuition waivers taxable. The effect on graduate students at Carnegie-Mellon below – I imagine it will be the same for physics and mathematics students. I don’t think any number of billionaires throwing in funding can/will help with this. If the tax bill passes, it will be the end of the American research university, in my opinion.

https://www.wired.com/story/grad-students-are-freaking-out-about-the-gops-tax-plan-they-should-be/

The Council of Graduate Schools has a worksheet (PDF) with a number of scenarios of the impact of the tax proposals on graduate students.

http://cgsnet.org/ckfinder/userfiles/files/CGS_Tax_Reform_Scenarios(1).pdf

or

https://goo.gl/2qReAb

Their main page on this topic is here:

http://cgsnet.org/tax-reform-resources

Anonyrat,

There are massive, \$1.5 trillion scale public policy problems with this tax legislation (and no, I won’t host a discussion of these here). I think academics are making a huge mistake to focus on this tuition issue instead of fighting the real problems. They look like they have no interest in anything beyond their very parochial concerns. The fact that universities charge Ph.D. students some often huge level of tuition, and then immediately turn around and give it back to them has always been a somewhat dubious piece of accounting. The supposed tax legislation problem for the students should be solvable if necessary (I doubt it will be) by reducing tuition numbers to zero for Ph.D. students the university doesn’t collect tuition from. Yes, I’m sure this creates a secondary effect of indirect budgetary problems for the universities, but then focus should be on those.

One thing I’ve been wondering about is what the current budgetary situation for physics/math research actually is. A new fiscal year has started, and as far as I can tell as usual there is no budget. The Trump budget announced earlier this year seems to have been dead on arrival but I haven’t heard what the real budget for the current year is looking like.

Assuming the desired outcome is that if a Google or Apple sponsors an employee’s PhD, they don’t get to pay zero tuition, then whatever tuition is charged in such cases, is the value that the Research or Teaching assistant PhD student is getting as a gift or as compensation, and tax will have to be paid.

The Senate bill preserves tuition waiver tax deductions, while the House bill does not.

In the meantime, both House and Senate versions of tax reform legislation would impose a 1.4% tax on investment income at private schools with endowments worth at least \$250,000 per full-time student. The tax would affect up to 70 schools and raise an estimated \$2.5 billion over a decade.

https://www.collegeraptor.com/college-rankings/details/EndowmentPerStudent

Columbia University with an endowment at \$337,580 per student will be subject to the 1.4% tax.

Anonyrat,

On the list of awful things about this legislation, the fact that my employer might have to pay a 1.4% tax on investment income is pretty far down the list.

To the extent there are organizations or grants actually paying Ph.D. tuition, that could be a significant budgetary problem. About Apple or Google not so much. These two companies have obscene amounts of money available, should have no trouble making sure that any employees they want to pay tuition for will be able to feed their families.

Just keeping on topic about funding for math, physics, academics.