Emanuel Derman has a fascinating new book out, Models.Behaving.Badly, which I’ve been intending to write about here for a while now. One of the problems that has kept delaying this is that every time I start to write something I notice that a new review of the book is out, and it seems to me quite a bit better than anything I have to say. An example that comes to mind is this review from Cathy O’Neil at mathbabe a while ago, another is a new one out today at Forbes. Any book that attracts so many thoughtful reviews has to be worth reading as well as capturing something important about what is going on in the world.

There is a somewhat frivolous virtue of the book that I haven’t noticed other reviews discussing: the wonderful title. I can’t help but enjoy the double meaning linking two of the out-of-control groups that are features of downtown life here in New York. One might think that drunken fashion models in downtown clubs and quants at financial firms don’t have a lot to do with each other, and yet…

Derman’s first book, My Life as a Quant (which I wrote a little bit about here in the early days of this blog) tells the story of his move from high energy theory into financial modeling. He was one of the first to do this, and that book reflects a time when the financial industry was riding high, with the role of quants and their models relatively uncontroversial. With his new book, he’s also one of the first, this time in his disillusioned but serious look from the inside at where we are today:

I am deeply disillusioned by the West’s response to the recent financial crisis. Though chance doesn’t treat everyone fairly, what makes the intrinsic brutalities of capitalism tolerable is the principle that links risks and return: if you want to have a shot at the up side, you must be willing to suffer the down. In the past few years that principle has been violated.

His focus is on the role that models inspired by physics have played in this debacle, arguing that they have been used in a fundamentally misconceived way, and explaining the evolution of his own understanding:

… I began to believe it was possible to apply the methods of physics successfully to economics and finance, perhaps even to build a grand unified theory of securities.

After twenty years on Wall Street I’m a disbeliever. The similarity of physics and finance lies more in their syntax than their semantics. In physics you’re playing against God, and He doesn’t change His laws very often. In finance you’re playing against God’s creatures, agents who value assets based on their ephemeral opinions. The truth therefore is that there is no grand unified theory of everything in finance. There are only models of specific things.

Much of the book is devoted to explicating his views about the importance of distinguishing between “theories” that are supposed to accurately capture phenomena, and “models”, which are metaphors which which only approximately capture some aspects of phenomena. As examples of theories, he discusses not just QED, the quintessential accurate theory of the physical world, but also Spinoza’s theory of the emotions. Besides the financial models that are the focus of the book, he also covers a wide range of other failed models. The book begins with a short memoir of growing up in South Africa, where he was a member of a Zionist youth organization, and its failed models as well as the racial ones of apartheid played a role in his coming of age.

If you’re part of the modern world which generally finds actual books too long and time-consuming to read, Derman has an often enjoyable blog, and for the truly ADD-afflicted, he also has one of the very few twitter feeds I’ve seen worth following.

FWIW I faced the career choice ten years ago of wether I should try to get a PhD, become a quant or do something entirely different (choosing the latter). After working on models in classical statistical physics, the necessary mathematical machinery for doing mathematical finance isn’t hard to learn.

But I was and am convinced that while the abstraction of fast varying degrees of freedom of 10^23 particles following static rules of dynamics may be of some value, transferring the modelling techniques to 10^4 or 10^5 interacting humans can lead to catastrophic failure only.

Several years later, in about 2005, I very much regretted my career choice, while watching the financial markets and the earnings of quants. In 2008 I was very much surprised how much I did not regret my choice then.

Meanwhile I start to regret the choice again, as I see how virtually all quants continue their work, and get a lot of money for it, after causing a global economic meltdown. I wonder what will happen during the next catastrophy, which almost surely will take place within the next decade (I know this, I have a sophisticated model) 🙂

I first met Dr. Derman nearly 20 years. I always considered him lucky in the sense that his job was quite academic by bank standard and he did not have to get his hands dirty as often as traders had to do.

_

I am glad that he has also reached the conclusion that I believe every financial professional with a conscience should have suspected by 2000 and be thoroughly convinced by 2008: Modern finance as practiced in the US is a game rigged for the powerful insiders. Contrary to what business schools have trumpeted over the years, no high level personnel in investment banks care a bit about optimal allocation of resources. The biggest rewards inevitably go to those who are the most nasty and shameless in ripping off first their customers and later the taxpayers.

_

While this kleptocratic arrangement goes all the way to every branch of government and therefore is a much bigger problem than finance alone, it was made significantly worse by the willing and enthusiastic participation of the financial academia. It is so easy and common to buy off a few big-shot professors and have them pump out fact-warping papers to push for more deregulation or excuse blatant thefts of public goods, all without the slight bit of disclosure, that even when caught red-handed, no one will suffer any damage either legally or in reputation.

_

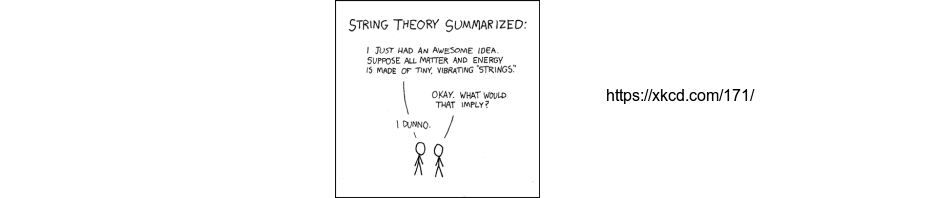

All this was a little hard to stomach for an ex-physicist like myself. I have escaped a field dominated by the nonsense that was string theory only to land among an immense group of shameless thieves. Although the string theorists have wasted 30 years of public resources pursuing an increasing pointless venue, the waste pales completely in comparison to the willful and wide-spread wrong-doings by financial academics and practitioners and their incredible damage to this nation and the world.

_

Those of you who had the fortune of not having to bear witness to the avarice and debauchery prevalent in the US banking industry of the past decade, consider yourself blessed.

I wonder if is Derman as sanctimonious as the quotes make him appear to be – because he sounds *very* sanctimonious indeed. (i.e. He is full of mea culpas but will be keeping the money. )

Why do you think Derman should give up his salary? To everyone’s best knowledge, he has never participated in ripping off clients or the taxpayers. He was hired to produce research papers on pricing options and he did a decent job of it.

Thousands of string theorists have produced no results relevant to this universe. Don’t they owe the public their salary back?

So, Visitor, if you observed the corruption from the inside, you’re culpable like everyone else, so you should STFU.

On the other hand, if you observed it from the outside, you’re ignorant and naive about how finance works, so you should STFU.

Enough venting on accusations of sanctimoniousness. On the question of linking risks and return, the real problem is that the risk takers can put other people—sometimes millions of other people—at risk besides themselves. When risk-taking is allowed to become systemic in that sense, it becomes very hard to just say “let ’em burn”. Of course, the risk takers wanted to pull as many suckers into the game as possible, and they convinced our elected representatives to help them do it—not that some of them needed much convincing.

If a gambler wants to indulge his proclivities, let him do so, but require that he not have any dependents. The goal is to protect the dependents—in particular, from being held hostage to ensure a bailout—and not to punish the gambler, who will be punished by his bad bets.

The point is all pretty much moot where the U.S. government is concerned. The 2008 bailouts were a one-shot deal; we can’t possibly afford to do them again. If we forget that, I think Japan and China (and much of Europe) will remind us.

Sorry folks, but I’m not about to try and moderate an open forum for everyone to explain what they think about economics or the financial system. If it’s not about Derman’s book, it’s off-topic here. There are lots of blogs out there devoted to economics and finance in general, try one of them.

Young ones finding back the wisdom of those who went before?

As Ludwig von Mises said in The Ultimate Foundation of Economic Science

The study of economics has been again and again led astray by the vain idea that economics must proceed according to the pattern of other sciences. The mischief done by such misconstructions cannot be avoided by admonishing the economist to stop casting longing glances upon other fields of knowledge or even to ignore them entirely. Ignorance, whatever subject it may concern, is in no case a quality that could be useful in the search for truth. What is needed to prevent a scholar from garbling economic studies by resorting to the methods of mathematics, physics, biology, history or jurisprudence is not slighting and neglecting these sciences, but, on the contrary, trying to comprehend and to master them. He who wants to achieve anything in praxeology must be conversant with mathematics, physics, biology, history, and jurisprudence, lest he confuse the tasks and the methods of the theory of human action with the tasks and the methods of any of these other branches of knowledge. What was wrong with the various Historical Schools of economics was first of all that their adepts were merely dilettantes in the field of history. No competent mathematician can fail to see through the fundamental fallacies of all varieties of what is called mathematical economics and especially of econometrics. No biologist was ever fooled by the rather amateurish organicism of such authors as Paul de Lilienfeld.

When I once expressed this opinion in a lecture, a young man in the audience objected. “You are asking too much of an economist,” he observed; “nobody can force me to employ my time in studying all these sciences.” My answer was: “Nobody asks or forces you to become an economist.”

According to Derman, “In finance, you can’t predict the future to even one decimal place.”

http://www.youtube.com/watch?v=PnK3CKtuL_k Emanuel Derman: Valuation and Its Discontents

“As examples of theories, he discusses not just QED, the quintessential accurate theory of the physical world”

I almost feel bad about making this comment since it is on QED, which is as far as I know the most successful thing ever made IMHO in physics, but isn’t fair to say QED is a model based on a theory (QFT) just as the SM, just as SM extensions…?

Allow me to advertise my own review of Derman’s fascinating book here:

http://allaboutalpha.com/blog/2011/11/10/derman-why-all-models-are-toys/

Thanks.

Bernhard,

I think Derman is trying to make a useful distinction, and using the terms “theory” and “model” to name it. The same terms do get used in different ways though. For instance, “string theory” refers to all sorts of very different things. The Standard “Model” is the name given to the most extreme case of a “theory” we have, in Derman’s usage. The general question of how mathematical structures like QED and the SM relate to the “real” world is a very interesting and intricate one, but I don’t think that’s what Derman is trying to get at. It seems to me that he’s mainly interested in examining why the models used in finance are of a different nature than things like the Standard Model.

@Bernhard.. “As examples of theories, he discusses not just QED, the quintessential accurate theory of the physical world”

Thanks for this.